Get Advice on Your Tax Declaration!

Lohnsteuer-Beratung Berlin LBB e. V.

- Lohnsteuerhilfeverein -

Who we are?

The LBB e. V. is a tax advising association for employees. We advise a lot of international members and expats on tax returns, tax classes, tax statements or filing protests.

How much does it cost?

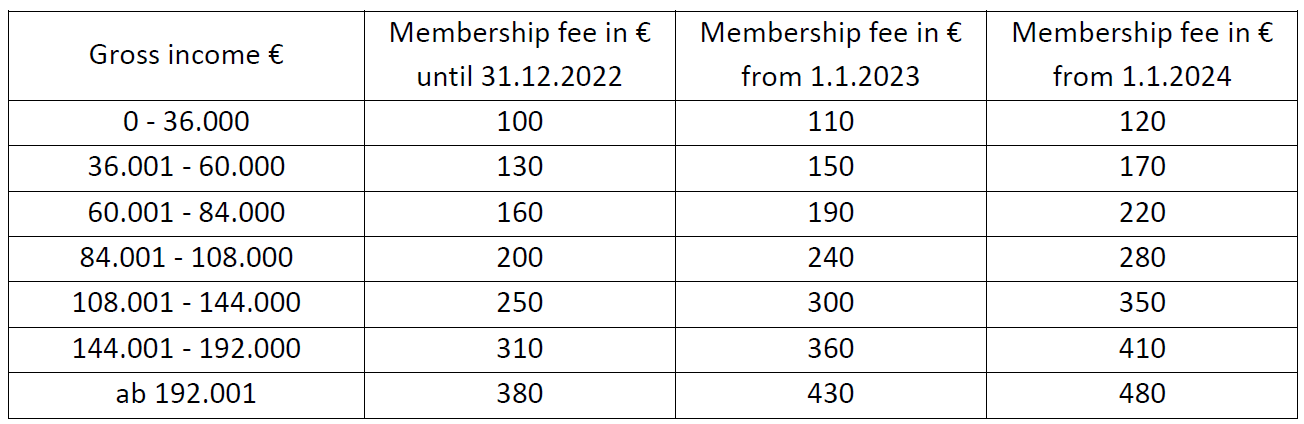

As we are a registered association, an annual membership fee will be required which depends on your income. However, 70% of our members pay 110€ or 150€ per year. In addition, an administrative fee of 10€ is due when you join. The regulations concerning the fees can be found here. The membership fee covers the cost of all of our services.

You will be asked to transfer the membership fee to our bank account after your first appointment. In subsequent years you will be required to transfer the fee at the beginning of the year.

What can we do for you?

Most of our clients want to get help with their STEUERERKLÄRUNG (tax return). But we can do more: We take care of your tax declaration, check the results, calculate income changes (e. g. Kurzarbeitergeld) and file protests if necessary. Thus, you do not need to have any direct communication with the tax office (Finanzamt) anymore.

I do not live in Germany (anymore) but let an apartment/house here. Can you help me?

If you let property in Germany, you have to declare this income in a special tax declaration. We can advise you, if every owner of the property is a member in our association.

What else do I have to know?

As an association we are not allowed to advise freelancer or companies. Please note that you will remain a member until you cancel your membership. Should you not have canceled your membership by the end of the year, you will be obliged to pay for the coming year irrespective of whether or not you make use of our services.

When do I have to send the tax declaration to the tax office?

Please notice that our members do not have to finish the tax declaration by 31st of July but 28th of February of the next year.

What is the next step?

Please give us a call to make an appointment: 030 290 280 330.